Society

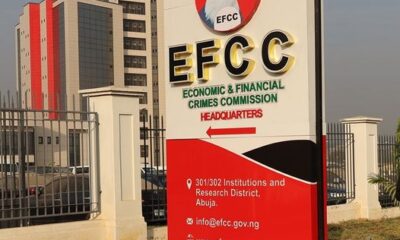

Why Bank Managing Directors Are In Trouble With EFCC Over Handling Of Ex President Goodluck Jonathan Election Campaign Funds!

…Inside the moves to play smart

Digs by societynowng.com have revealed why a handful of the Managing Directors of the nation’s banks are in trouble with anti graft agency, Economic and Financial Crimes Commission over the handling of the re election campaign fund of former President Goodluck Jonathan- particularly monies from the office of the National Security Adviser.

According to information available to societynowng.com ”they attempted to play smart…enrich themselves personally”

According to a top level informant ”many would wonder why some of them are being given grief for performing their perceived

function of handling monetary transactions…the truth is they failed to play by the rules of their regulators”

Societynowng.com learnt all the indicted bank bosses failed to report the transaction(s) that earned them arrest to appropriate authorities as the mandates of their operations require.

”In virtually all the cases, they by passed the procedure and failed to report the inflow of money to stipulated agencies…and when investigation started, this became an indictment” a source explained

Societynowng.com learnt the anomaly allowed most of the banks concerned to clandestinely reap increased profits and helms men personally make gains of their own.

Societynowng.com learnt those that stuck to the rules but were involved the transaction have escaped the mess of having their head office stormed by anti graft operatives in search of documents, interrogation and possible detention of their Managing Directors.

They simple furnished investigators with their paper work which is self explanatory societynowng.com learnt.

Those who fall into this category are listed very few.

Societynowng.com anti graft agency, Economic and Financial Crimes Commission was forced to tone down publicity trailing investigations of indicted bank bosses based on great pressure from stakeholders in the banking and related sector.

According to information available ”The move is meant to protect confidence of investors, particularly foreign in ongoing investments Nigerian banks are involved in..

”’that is why aside the initial arrests the others now enjoy very few mentioning in the media, the EFCC and other investigating agencies have been convinced the implications for the system and country far outweighs the issues of funds at stake’’

Societynowng.com learnt it took the intervention of pulling strings in the presidency by stakeholders before the status quo in the manner of investigating indicted Bank Managing directors came to be.