Business

How UBA CEO Alawuba Is Working Behind The Scene To Surpass N853Billion Earnings

thrown into the mix are incentives for better performances

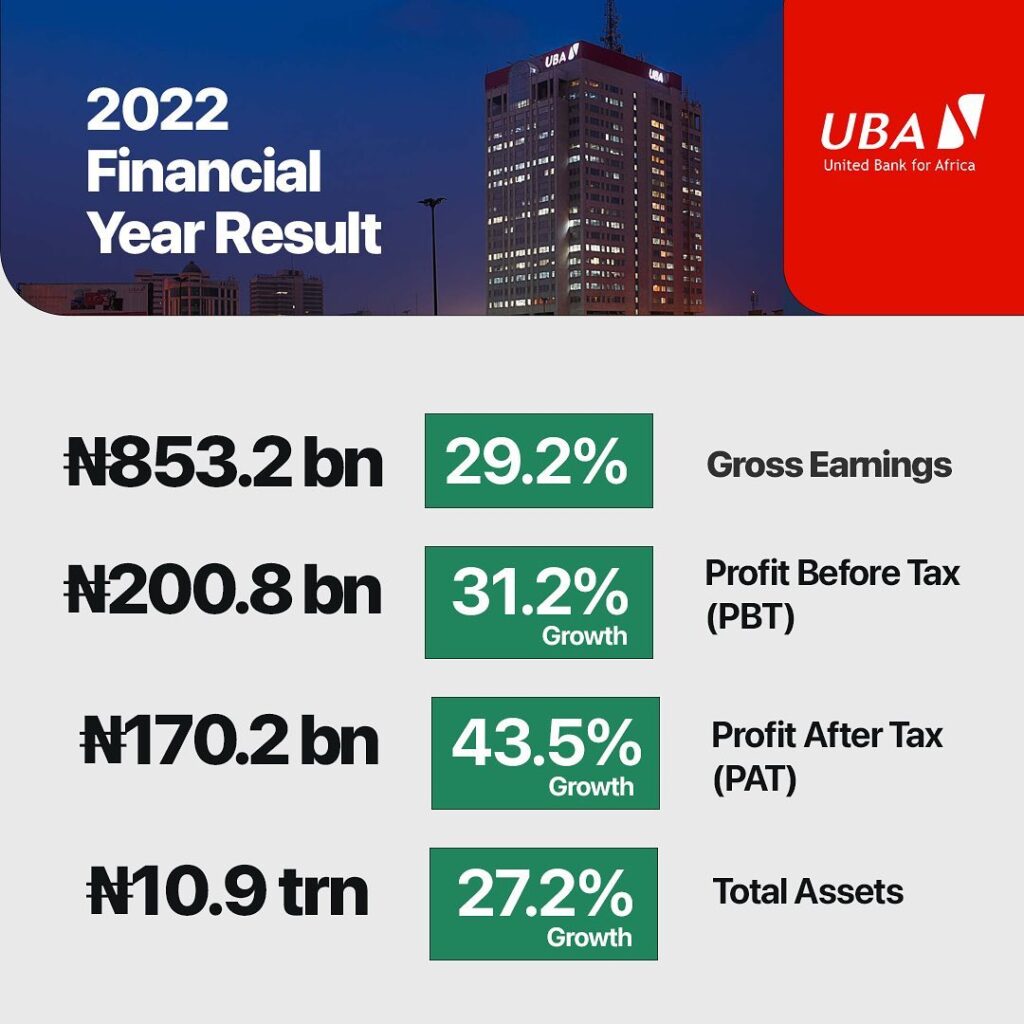

In its latest financial statement, United Bank for Africa (UBA) outdid itself with gross earnings of N853 billion for the 2022 financial year, a 29.2% jump in revenue compared to the previous year.

Chief Executive Officer, Oliver Alawuba has, however, declared his intention to surpass the result that saw profit after tax increase by 43.5% to N170 billion in 2022 from N119 billion in 2021 to make shareholders – investors happier.

The information available revealed that the overseer of the group which increased its presence to 24 countries across four continents – Africa, America, Europe, and Asia – additional operations in UAE (Dubai) has already laid the foundation before declaring intention.

SocietyNow.Ng gathered although the business strategy at UBA remains to continue to focus on satisfying customers’ needs ” leveraging on the key pillars driving our Customer First (C1st) Philosophy i.e. People, Process and Technology, in delivering positive experiences across all our touchpoints – physical and virtual” as disclosed at the recent ” Investors and Analysts Conference”, the CEO is putting in extra work on “an added focus” to get things done.

Digs by SocietyNow.Ng revealed that Alawuba has taken steps to make the over 25,000 employees of UBA group firmer believers in achieving the objective(s).

Those who should know revealed that the grounded banker who took over as chief executive officer on August 1, 2022, has taken pains to visit the group’s subsidiaries across different continents to explain and motivate staff on the need to work fiercely towards doing better than is.

In making the travels, the bank chief with over 20 years top-level experience is said to be among other things oiling, renewing, and forging results-oriented professional and personal relationships with those he is working with.

” As a strong show of faith, he has had welfare packages of staff scaled up since he came on board including a 20% salary raise” SocietyNow.Ng gathered.

Added information revealed that thrown into the mix are incentives for better performances.

Details available revealed that working in Alawuba’s favor is the fact that he was a very active former deputy managing director of the Group that is serving the financial needs of over 35 million customers globally.

Those who should know insist that the group chief executive officer who was at different times MD/ CEO of UBA Ghana Ltd, MD/CEO of UBA West Africa, Directorate Head, Public Sector and Personal Banking, and Regional CEO, of UBA Africa – Anglophone has brought greater zeal to bear as the overall head.

“So what he has done is to create a strategy within a strategy. The strategy disclosed at the bank’s investors conference to surpass the latest declared earnings and another strategy that is intentionally transforming those implementing the first strategy into greater believers. And he is passionately spearheading the two strategies targeted at gladdening customers, investors, and staff ” SocietyNow.Ng learned.