Business

Here Are The Peacemakers Who Rescued Nigerians From The MTN, Banks USSD Fiasco

The face-off between telecommunication company MTN Nigeria and a larger percentage of Nigerian Banks would have worsened but for the intervention by some powerful peacemakers.

Inside Details: The Powerful Players Behind MTN & Bank’s USSD Fiasco

Societynow.ng gathered that the peacemakers prevailed on MTN Nigeria to drop the planned reduction of the commission collected by aggregators and the banks (from 4% to 2.5%) while the Banks with Access Bank CEO Herbert Wigwe and GT Bank front person Segun Agbaje leading charge were made to re-open their platforms to MTN Purchase services.

The Banks had without notice to customers yanked off MTN Nigeria’s Purchased Services from their payment platforms on receipt of notification of the plan to reduce their commission by the Telecommunication company.

The development which threw many Nigerians into great discomfort was meant to be a ferocious resistance to the move by MTN Nigeria

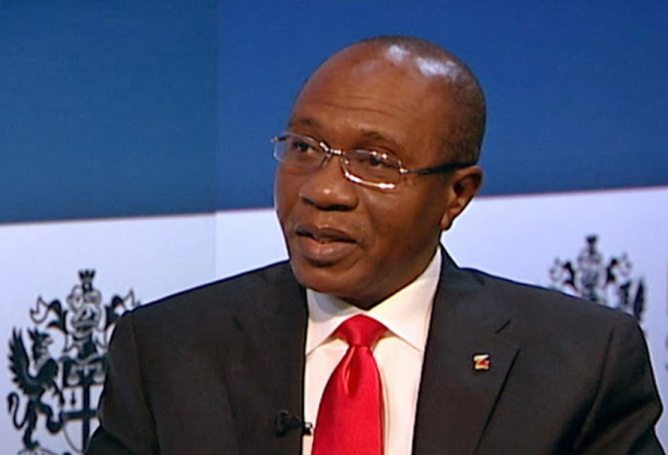

Peacemakers include Umar Garba Danbatta, the Chief Executive Officer (An Vice Chairman) Nigeria Communication Commission (NCC), Gbenga Adebayo, the President ALTON (Association of Licensed Telecommunications Operators of Nigeria), Isa Pantami, the Minister for Communication and Digital Economy and Gowin Emefiele, the Governor of the Central Bank of Nigeria initiated urgent steps to bail out Nigerians from the fiasco.

Insiders disclosed that these peacemakers pressured representatives of the Banks led by Access Bank CEO Wigwe and MTN Nigeria lead man Carl Toriola to the negotiation tabl

Revealing the roles of the peacemakers an insider disclosed that, Danbatta who oversees NCC insists that the stance of the Telecos as defined by MTN is very correct but their push for recovery of debt from the Banks and related moves be done by the book.

Added information has it that Adebayo who Presides over ALTON is also solidly behind MTN Nigeria – and the Telecommunication companies – for obvious reasons. ALTON is solely an Association for all Licensed Telecommunications Operators in Nigeria. Insiders, however, insist that despite the interests it represents ALTON doesn’t want an all out confrontation that profits those with no stake in the issues at stake under the guise of taking sides.

Further finding has it that Minister Pantami is fighting hard to remain neutral in the scheme of things and towing the line of “the dispute between Banks and Telecommunication companies must not discomfort Nigerians” – unduly.

There are, however, talks that the Minister is tilted towards the Telecos because of belief their cause has sound footing.

Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN) is said to be wielding a very huge influence in the efforts at resolution of the conflict.

He is said to be strongly backing the Banks – where he rose from to his president position – and using influence of the power of approval over something of vital to the future plans of the Telecommunication companies to get his recommendations adopted..

Societynow.ng learned that whatever their interests and sides in the issue at stake it was agreed that the discomfort to Nigerians with the shutdown of MTN Nigeria purchase services by the Banks should be removed.

At a meeting held on Sunday, April 11, 2021 the Banks agreed to re-open their platforms to MTN Nigeria services while the mobile operator suspends the planned reduction in commission on every charge to allow for further engagements on issues that resulted in the face-off.

The information available to societynow.ng revealed that at the heart of the face-off are three major issues being worked out as negotiations continue.

The first is the debt of N42Billion deducted from customers that the Banks are yet to remitted to the mobile operators.

The second is said to be an attempt by the Banks to shift the debt to customers in the guise of slightly increased charges that postures MTN Nigeria – and other telecoms providers – as the bad guy (but helps the Banks get out the debt mess and continuing profit cost free because the mobile operators service the USSD platforms generating the income).

The third issue reportedly causing bad blood is said to be the approval for banking license by the telecommunication companies.

“The banks are kicking very hard against this because it threatens their operations, they have not innovated and the trend is taking their share of the market from them piece meal. With the Fintechs and related finance firms sprouting up and the Telecommunication making audacious bids into new terrains as part of survival strategies, the Banks which stuck to convention all these years see a scary future and are heavily peddling influences to limit incursions into their areas of operations to prolong their shelf life” societynow.ng learned.